Are we at the climax?

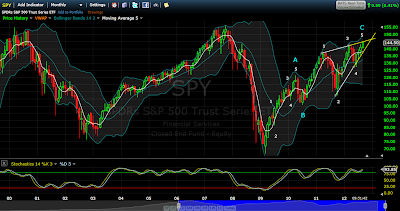

I present three charts below - the daily, weekly and monthly SPY. The tape has been playing out as I charted last month. The conditions were not ripe then for a top but are ripe now.

1. We are in the overbought range of the stoch on daily, weekly and monthly.

2. With divergence on daily and monthly to boot.

3. In EWT terms, we have completed a structure with good overall fib ratios.

We could stretch a bit more (that would be a good top) by about 20-30 points without breaking the bearish setup (88.6 fib retrace of the crash of 2007-9)

Of course, we could keep stretching up and set a new high and never look back :-) But here is a point to pause and think.

Where do we head from here? When bearish wedges break, they typically retrace to the place where they started. In this case 100 SPY would not be far fetched. A lot hinges on Fed and ECB printing more money. We should get that shot in the arm at around this number if Fed does not print right away.

No comments:

Post a Comment